Special Enrollment Period (SEP)

What is a Special Enrollment Period?

A Special Enrollment Period is a time outside of the yearly Open Enrollment Period when you can sign up for health insurance through the marketplace.

Qualifying for a Special Enrollment Period

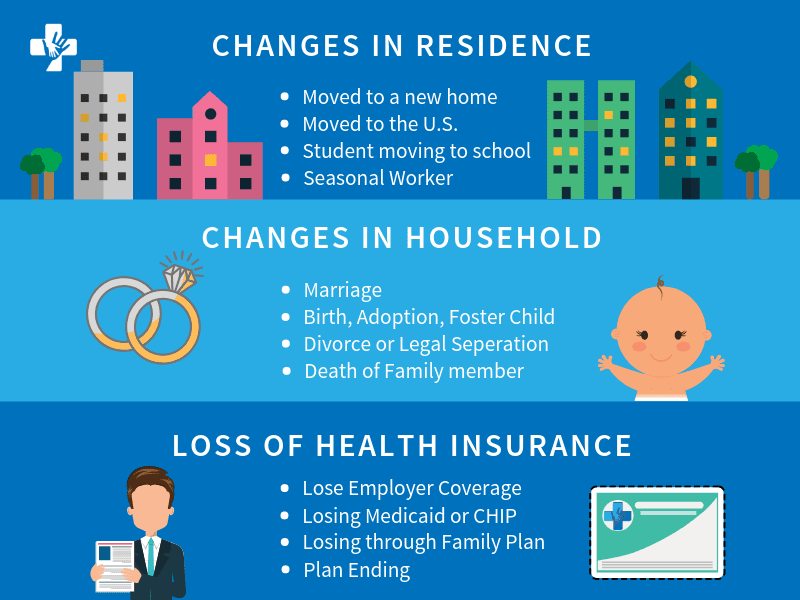

Changes in household

You may qualify for a Special Enrollment Period if there has been any of the following changes in your household within the past 60 days:

- Marriage You may pick a plan by the last day of the month of marriage and your coverage can start the first day of the next month.

- Death If someone on your marketplace plan dies and you’re no longer eligible for your current insurance plan as a result, you may be eligible for a Special Enrollment Period.

- Birth, adoption of a child, or placed a child for foster care Your coverage can start the day of the event. Even if you enroll up to 60 days after the event, coverage will be retroactive to the day of the event.

- Divorce or legal separation You must lose health coverage to be eligible. Divorce or legal separation without the loss of coverage will not qualify you for a Special Enrollment Period.

If you do qualify for an SEP, you typically will have up to 63 days following the event to enroll in another plan. If you miss that window, you may have to wait until the next Open Enrollment Period to apply or find a private health insurance plan.

See if you qualify by using our Special Enrollment Screener Here.

Changes in residence

If you move, you may qualify for a Special Enrollment Period. Qualifying changes in residence include:

- Move to a new home in a new zip code or county

- Move to the U.S. from a foreign country or United States Territory

- If you are a student who is moving to or from the place you attend school

- If you are a seasonal worker who is moving to or from the place you live and work.

- Moving to or from a shelter or other transitional housing

Important: You must provide proof of qualifying coverage before your move if you live inside the United States.

Note: Moving for medical treatment or staying somewhere for vacation does NOT qualify you for a Special Enrollment Period.

Loss of health insurance

If you or anyone in your home has lost qualifying health coverage in the last 60 days or expects to lose coverage in the next 60 days, you may qualify for a Special Enrollment Period.

Some common reasons that will qualify for a Special Enrollment Period:

- Losing employer-based coverage

- Losing coverage for a plan you bought for yourself

- Losing Medicare, Medicaid or CHIP eligibility

- Losing coverage through a family member

More qualifying changes for Special Enrollment Periods

- Gaining membership to a Federally Recognized Tribe or status as an Alaska Native Claims Settlement Act (ANCSA) Shareholder

- Recently becoming a U.S. Citizen

- Leaving incarceration

- Starting or ending service as an AmeriCorps State and National, VISTA, or NCCC member

IMPORTANT: You will most likely have to verify your claims

If you decide to utilize your Special Enrollment Period option, you must attest that the information you provide on the application are true. You may have to provide documentation to prove your eligibility to enroll during the Special Enrollment Period.

Special Enrollment Periods for complex issues

You experience an exceptional circumstance

You faced a serious medical condition or natural disaster that kept you from enrolling such as:

- An unexpected hospitalization or temporary cognitive disability, or where otherwise incapacitated

- A natural disaster, such as an earthquake, hurricane or flooding

You experience a Marketplace enrollment or plan information display error

Misinformation, misrepresentation, misconduct, or inaction of someone working in an official capacity to help you enroll (like an insurance company, navigator, certified application counselorm, agent or broker) kept you from:

- Enrolling in a plan

- Enrolling in the right plan

- Getting the premium tax credit or cost-sharing reduction you were eligible for

A technical error occurred when you applied through the Marketplace – you would see an error message when completing the application – and that prevented:

- You from enrolling in a plan

- Your health insurance company from receiving your enrollment information

Or if the wrong plan data was displayed on the Marketplace at the time you selected your health plan, such as benefit or cost-sharing info.

You live or previously lived in a state that hasn’t expanded Medicaid and you become newly eligible for help paying for a Marketplace insurance plan

If you previously lived in a state that hasn’t expanded Medicaid and weren’t eligible for Medicaid or advance payments of the premium tax credit because your income was too low, but in the last 60 days you had an increase in household income or moved and that makes you newly eligible for premium tax credits, then you may qualify for a Special Enrollment Period. In other words, if you didn’t qualify for a market plan because your income was too low (and therefore would have qualified for expanded Medicaid in another state), and now you make enough money for a marketplace plan, you may qualify for a Special Enrollment Period. The reasoning is that losing Medicaid would have qualified you if you were in a state with expanded Medicaid.

You are determined ineligible for Medicaid or CHIP

If you applied for Medicaid or CHIP during the Marketplace Open Enrollment Period and your state Medicaid or CHIP agency determined that you weren’t eligible for Medicaid or CHIP after Open Enrollment ended. You may qualify for a Special Enrollment Period regardless of whether you applied through:

- The Marketplace and your information were sent to your state Medicaid or CHIP agency

- Your state Medicaid or CHIP agency directly

You gain or become a dependent due to a child support or other court order

If you gained a new dependent or became a dependent of someone else due to a court order you may qualify. Your coverage would start the effective date of the court order - even if you enroll in the plan up to 60 days afterward.

You experience domestic abuse/violence or spousal abandonment

If you are a survivor of domestic abuse/violence or spousal abandonment and want to enroll in your own health plan separate from your abuser or abandoner you may qualify. You can enroll by contacting the Marketplace. Your dependents may also be eligible.

If you are married, you can answer on your Marketplace application “unmarried”, without fear of penalty for misrepresenting your marital status. This would make you eligible for a premium tax credit and other savings on a Marketplace plan, if you qualify based on your income.

If you qualify for this Special Enrollment Period, you’ll have 60 days to enroll in a Marketplace plan.

You get an appeal decision that’s in your favor

If you believed you got the wrong determination for your Marketplace eligibility and filed an appeal with the Marketplace, and they decide in your favor, you will be given the option to enroll in or change plans.

Filing an appeal

If your request for enrollment was denied, you can file an appeal. If the denial is found incorrect, you can get coverage back dated to the date you were denied.

How to file an appeal:

- Select your states appeal form, download/fill it out

- Mail your appeal to:

Health Insurance Marketplace

Attn: Appeals

465 Industrial Blvd.

London, KY 40750

IMPORTANT: Recently impacted by a hurricane or other natural disaster?

If you were qualified to enroll in Marketplace coverage during Open Enrollment or a Special Enrollment Period but were unable to enroll due to a hurricane or other natural disaster, you may be eligible for another Special Enrollment Period. To qualify, you must live (or have lived during the event) in a county that is eligible to apply for “individual assistance” or “public assistance” by the Federal Emergency Management Agency (FEMA). If you are eligible, you have 60 days from the end of the FEMA-designated incident period to complete your enrollment in Marketplace coverage and request a retroactive start date based on when you would have picked a plan if not for the disaster. See the following link for FEMA designation information: https://www.fema.gov/disasters. For help enrolling through this Special Enrollment Period, contact the an agent here.