Compare: HMO vs. PPO?

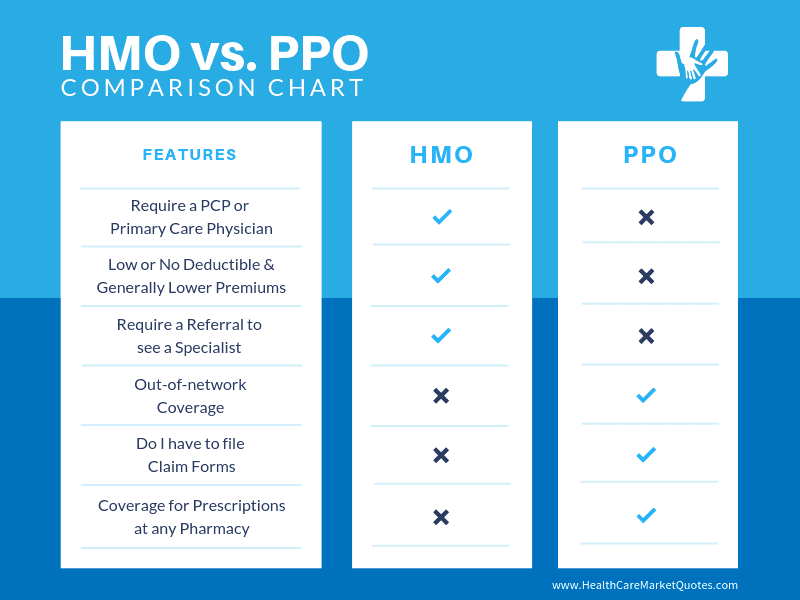

There are two main types of health plans: an HMO or a PPO. There are benefits to each as well as some downsides. We will go over all the differences and how they would impact you. In most states, you will have access to both options through the Obamacare marketplace. The main differences between the two plan types are:

- cost

- doctor access

- size of the network

- out-of-network coverage

What is an HMO?

HMO stands for a Health Maintenance Organization. As the name implies, an HMO’s primary goal is to keep you healthy. They usually provide preventative care at lowered or no cost. The reasoning is that it’s cheaper to keep you healthy rather than paying for treatment after being diagnosed with a preventable medical condition.

HMO’s give you access to a set of doctors and hospitals within their network. These doctors and facilities have agreed to provide services at a pre-negotiated price. Because HMO’s only contract with a certain number of doctors and facilities, you will be limited to where you can receive coverage. Most also have annual limits to the amount of doctor visits and tests.

What is a PPO?

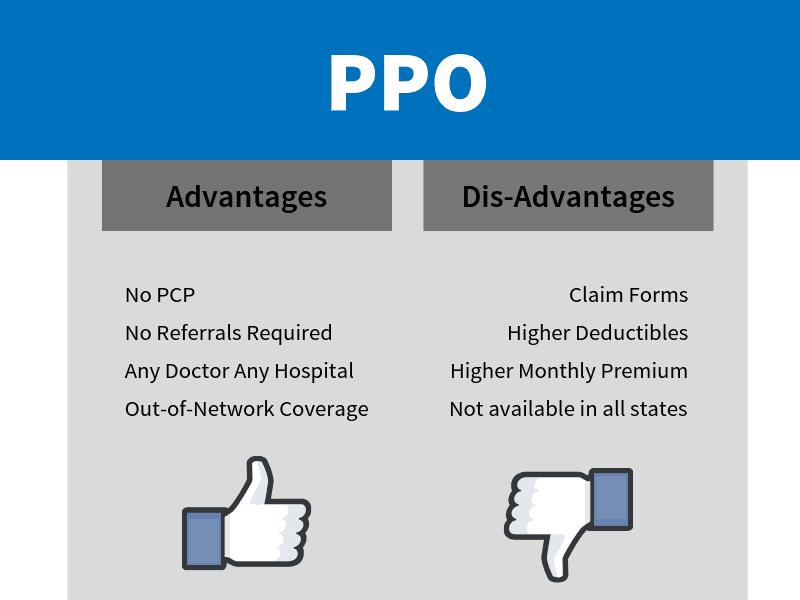

PPO stands for Preferred Provider Organization. They are subscription based medical care arrangements. PPO’s provide the most flexibility compared to any other plan types. But that flexibility does come with a higher price tag in most cases.

Similar to HMO’s, a PPO has a network of health care providers. But they also offer out-of-network coverage and do not require referrals to see a specialist. The reason you do not need referrals is because you will not have a PCP.

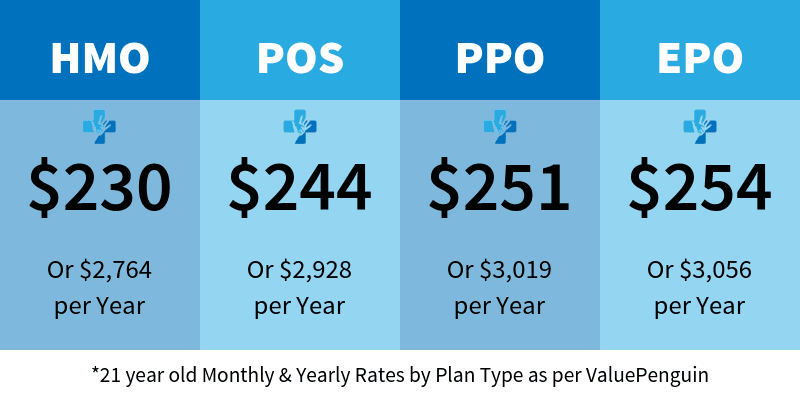

Cost Difference between an HMO and a PPO

In most cases HMO’s will have a lower monthly payment compared to a PPO health plan. HMO’s will usually have lower co-payments as well as deductibles. While most costs are lower with an HMO you must use your PCP and need referrals to see other doctors which can greatly impact your cost. Not to mention the fact you will have no out-of-network coverage with most HMO’s.

While PPO’s cost slightly more, lower premium plans usually equal higher out-of-pocket expenses when used. PPO’s are usually more extensive in coverage, including some services you may have to pay extra for with an HMO.

Access to Doctors

Here is where the main differences between an HMO and a PPO will come to light. With an HMO you will usually need a PCP or Primary Care Physician who is responsible for managing your care. You will need to see this doctor for everything, and if he sees fit he will then give you a referral to a specialist. With a PPO you usually don’t need a PCP and can choose which doctor you can see and can change at will.

With an HMO in most cases you have no out-of-network coverage, meaning if you end up using a doctor or facility that is not in-network you will be responsible for the entire bill. Keep in mind, sometimes the surgeon is in network, but not his assistant or the anesthesiologist. With a PPO you have access to any doctor and any hospital, and you will still receive coverage. In most cases you may have slightly less coverage or incur a separate deductible but will still receive coverage.

Flexibility is the main factor, when it comes to choice of doctors, between an HMO and a PPO. The fact that you can choose which doctor will perform surgery on your child—instead of being forced to use the in-network doctor—is a huge deciding factor to many. In general PPO’s usually have a much larger network of doctors that will accept your insurance.

Is an HMO or a PPO better for me?

When choosing between an HMO and a PPO there are many factors to consider and really depends on your situation and health needs. Here are some things to consider before choosing

· Monthly cost

· Out-of-pocket costs

· How often do you see a specialist?

· How often do you travel?

· Can you keep your doctors?

· Do you need to keep your doctors?

If you do not travel much and do not use specialists often, an HMO can be a lower cost alternative to a PPO. But if flexibility and ease of access is your main goal, a PPO will most likely be better for you and your family.

There are other options outside of the Marketplace such as Short-Term Health Insurance plans or Group Association plans recently expanded through Trumpcare.

Here at Health Care Market Quotes we always recommend speaking to a licensed agent to go over your available options to ensure you get the best plan for your situation.